Lies and Statistics: Phil Donohue

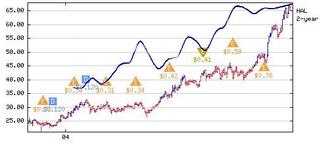

Something I heard today really ticked me off. On the O'Reilly Radio Factor show, which I listen to only occasionally if I happen to be driving in my car when it is on (Seattle's KTTH broadcasts it from 6 pm, which is a delayed broadcast), and O'Reilly rebroadcast an audio segment from his TV show last night, in which him and Phil Donohue went at it about Iraq. Donohue's opinion is Donohue's opinion, and he was doing a lot of "When did you stop beating your wife?" type questions and assertions. Well, in the midst of this back-and-forth debate (more like hissy-fit), Donohue made a "damning" assertion, about how Halliburton's stock had doubled since the war in Iraq started. O'Reilly didn't respond to this, but it was a late assertion so he had little time left to do so. It's a fact that Halliburton supplies oil-field equipment and supplies. So it profits even if oil prices are flat or declining -- oil companies still need equipment and supplies regardless of the oil demand/price. First of all, if Halliburton's stock price had doubled, well, I wish I had gotten in on it, but I didn't. I just knew Donohue had to be screwing with the facts in some way, so I thought I would have a look at their stock chart. And since I was pretty sure that crude oil prices had been going up over the past two years, I thought I would chart that too and see what kind of correlation I'd get. Because Halliburton's stock price and the price of oil per barrel are fortunately in the same range (that's interesting in and of itself), I superimposed the oil price history (extracted from a chart at NeatIdeas.com) over Halliburton's stock price history (from eTrade). Check this one out:  It is entirely clear from HAL's stock price that it got a rise of about $5 per share after getting the contract to fix Iraq's oil infrastructure. This was only natural, as getting any good contract would have done the same. But then what happened? Stayed more-or-less flat for half of 2004. After that it started trending with the price of oil. In other words, Halliburton's stock price isn't pegged to Iraq, it is pegged to the price of oil! And that, dear friends, has to do with the increasing worldwide demand for oil that is outpacing production increases. Halliburton makes more money when the oil industry is expanding exploration and production, and that happens naturally when oil prices trend upwards. Simple economics. |

0 Comments:

Post a Comment

<< Home